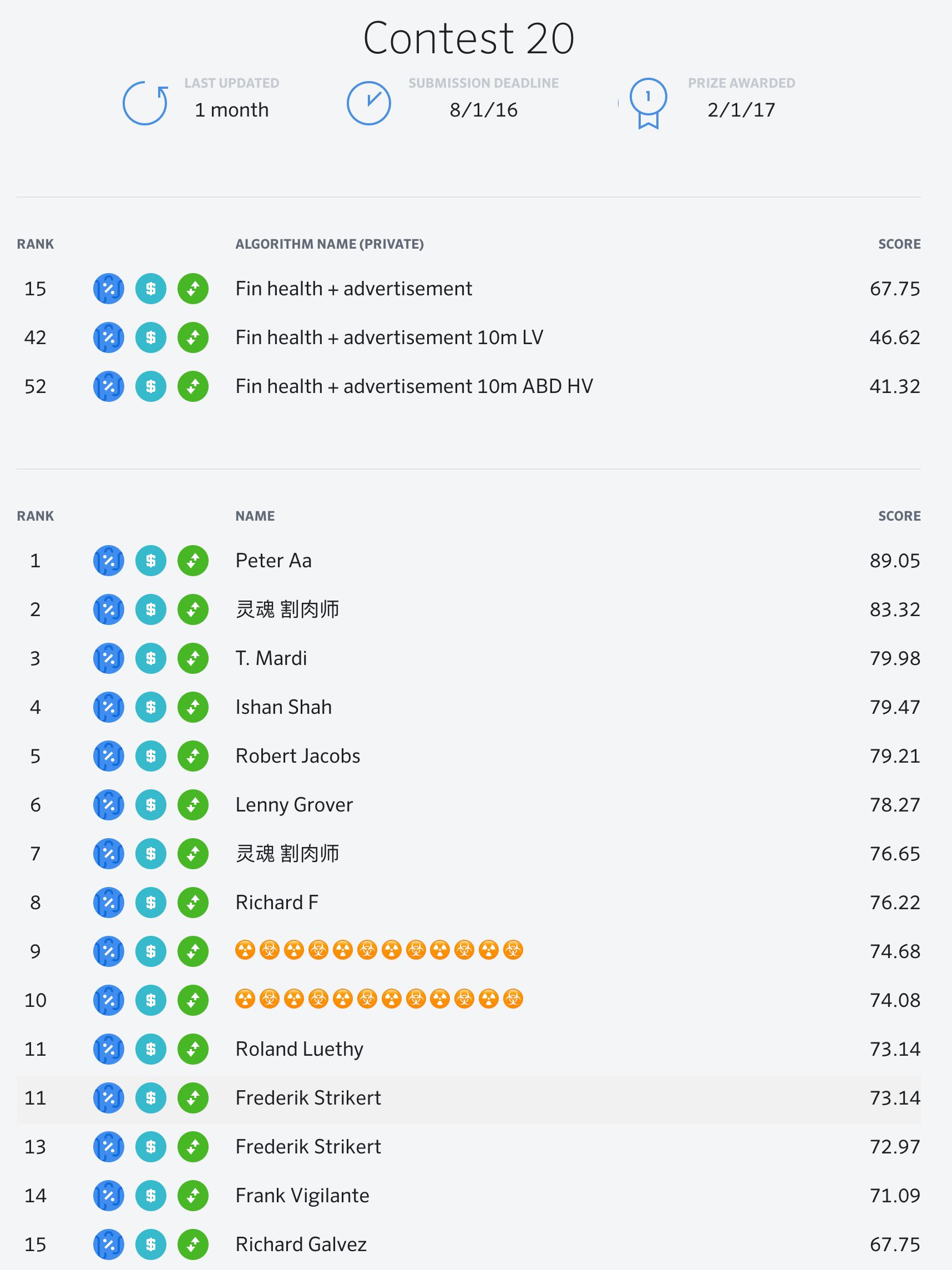

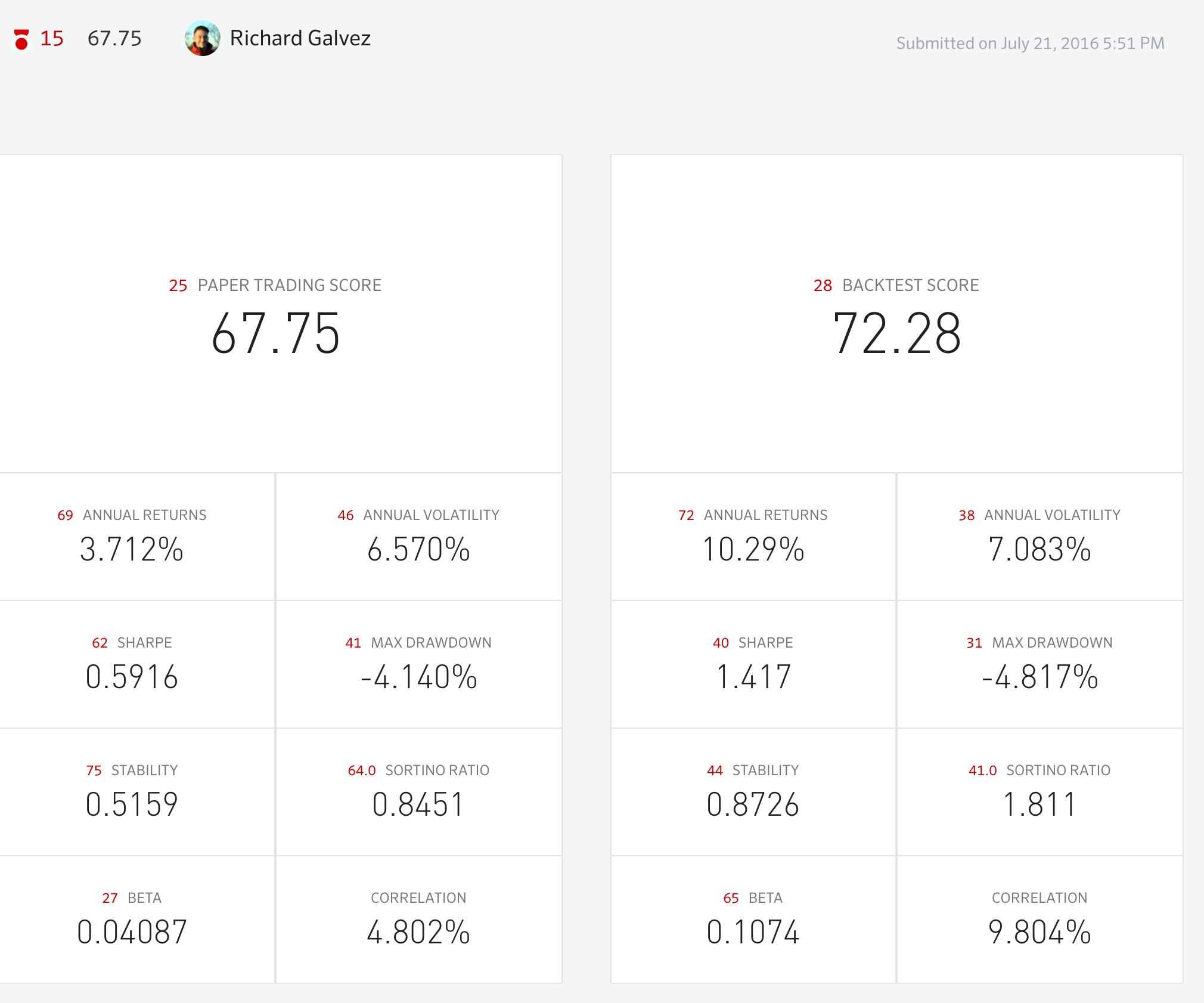

Placed 15th in an algorithmic stock trading competition

For those who know me personally, it’s no secret that I enjoy economics and financial analysis. For this reason I was pretty excited when I discovered the Quantopian platform/website (quantopian.com) about 8 months ago or so. Quantopian is great, and if you’ve ever considered algorithmic stock trading, I highly suggest looking into it. Effectively, quantopian provides a python platform and a convenient interface to minutely pricing data on public companies traded within the United States.

Beyond pricing data, one of the most valuable aspects of the site is the access they provide to “fundamental” data. The fundamentals of a company is the information companies report based on their operational status/health, such as their current levels of debt, how much they’ve invested by quarter in research and development, advertisement, total revenues, etc, etc. Among the many schools of stock trading, those investors which rely mostly on fundamentals data as opposed to those who utilize statistical measures or momentum based strategies, are usually dubbed ‘value-based’ investors. In an ironic twist (considering my technical background), I subscribe entirely to the value-based investment school of thought.